As I am pretty pressed for time, I am going to do a little less in depth overview of other coins to watch in the short to mid term. You will need to do a little reading for this one.

Eternity (ENT)

Market Cap: 1.4$ million

Price: 0.35$ / 0.00003519 BTC

Purpose of coin: Payment platform.

Website: http://ent.eternity-group.org/

Quantum RL (QRL)

Market Cap: 70.6$ million

Price: 1.36$ / 0.0001350 BTC

Purpose of coin: Communication layer to tackle quantum computing threats.

Website: https://theqrl.org/

|

theqrl.org

The Quantum Resistant Ledger (QRL) is a blockchain designed to withstand the computational attacks possible on other blockchains as the developments in quant…

|

Edgeless (EDG)

Market Cap: 73.6$ million

Price: 0.89$ / 0.00008902 BTC

Purpose of coin: Ethereum based casino.

Website: https://edgeless.io/

Vibrate (VIB)

Market Cap: 45.1$ million

Price: 0.27$ / 0.00002712 BTC

Purpose of coin: Community for musicians, venues, events, gigs, and contact info for music.

Website: https://www.viberate.com/

|

A global platform for musicians, venues and music events. All in one place, presented with rich profiles. Register for free.

|

||

Deep Onion (Onion)

Market Cap: 51.7$ million

Price: 4.95$ / 0.0004886 BTC

Purpose of coin: Privacy coin using TOR.

Website: https://deeponion.org/

|

deeponion.org

DeepOnion is an anonymous cryptocurrency that is untraceable. All transactions are private and sent through the TOR network.

|

||

Unify (UNIFY)

Market Cap: 2.8$ million

Price: 0.15$ / 0.00001555 BTC

Purpose of coin: Crypto ecosystem for crowdfunding.

Website: http://www.unify.today/

|

Unify is cryptocurrency made for crowdfunding

|

||

Sugar (SGR)

Market Cap: 0.5$ million

Price: 0.14$ / 0.00001465 BTC

Purpose of coin: Crypto exchange.

Website: http://sugarexchange.io/

|

sugarexchange.io

is a new type of cryptocurrency trading platform utilizing proven methods, as well as implementing advanced technology to ensure a superior user experience.

|

Nebulas (NAS)

Market Cap: 330.2$ million

Price: 9.30$ / 0.0009118 BTC

Purpose of coin: Crypto search engine.

Website: https://nebulas.io/

|

nebulas.io

Nebulas is a decentralized platform which provides a search framework for all blockchains.

|

Icon (ICX)

Market Cap: 1.7$ billion

Price: 4.64$ / 0.0004546 BTC

Purpose of coin: Decentralised network connecting real world businesses with blockchain.

Website: https://www.icon.foundation/

|

ICON은 다양한 Blockchain Community가 연결된 탈중앙화 네트워크입니다.

|

Maid Safe Coin (MAID)

Market Cap: 220.1$ million

Price: 0.48$ / 0.0000484 BTC

Purpose of coin: Data Storage network.

Website: http://maidsafe.net/

|

Expanse is an Ethereum based blockchain platform for smart contracts.

|

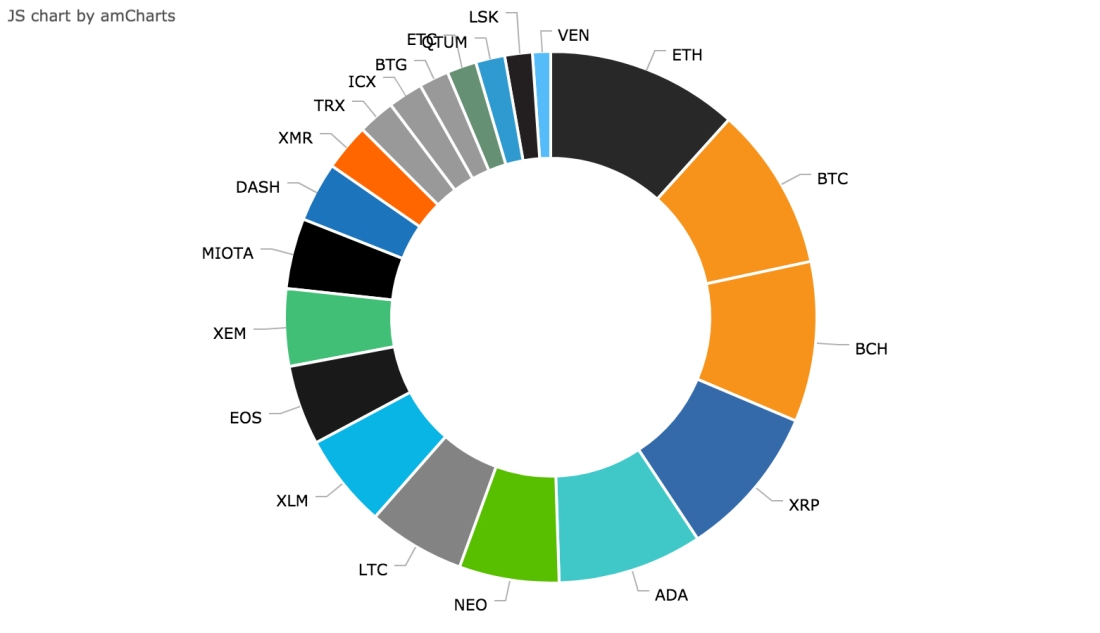

Two other coins with high potential are Cardano and NEO. There is a lot of information online about both of these projects. As these two projects are major coins they are more sound but offer longer hold positions.

- Information presented here, including any ideas, opinions, views, predictions, forecasts or crypto picks, expressed or implied are for informational and educational purposes only. The coins posted should not be construed as personal investment advice.